Analyzing Curio Card Sales — The Rise and Fall of The Apple

August 4, 2021 - 5 min read

In this article, I analyze the Curio Cards Apple sales - from 4.75 ETH to 2.75 ETH (a $5,000 loss) in 24 hours).

A lesson on supply and demand in NFTs

Curio Cards is a set of digital artwork released in 2017 on the Ethereum blockchain. The set has 30 cards in total (with one additional misprint card) and has been getting some attention lately because it’s been recognized as the first Ethereum block-chain NFT.

Cryptoslam.io tracks 24 hour, 7 day, and 30-day sales volumes for NFT projects and Curio Cards cracked the top 5 yesterday for 24 hour sales volume:

Source: Cryptoslam

A lot of money flowed into this project, nearly $2 million!

While exciting, this in-flow of money provided some amazing data to help us understand supply and demand of NFTs so we can be more informed and thoughtful in our purchases.

I’ll analyze the sales data of card #1, Apple. This was the third card I bought in my collection (I own 2 Mona Lisa’s, 1 BTC, and 1 Apple).

The reason I’ll focus on this card is the reason many people are pausing to take a look at Curio Cards — because of the history.

The Apple card was the first sale of the set, making it the first Ethereum NFT ever sold.

If the Apple card is so important, why did it reach a peak price and then immediately fall?

This is where you need to pay attention — on 8/3, the Apple card had a sale for 4.75 ETH ($11,875), a record sale (preceded by a few other record sales):

Source: Opensea.io

Almost immediately, the price started dropping and it lost 2 ETH ($5,000) value:

Source: OpenSea.io

If you’re savvy, you would look to this chart for clues:

Source: Opensea.io

For every peak of the Apple card, there’s been an immediate retraction in value.

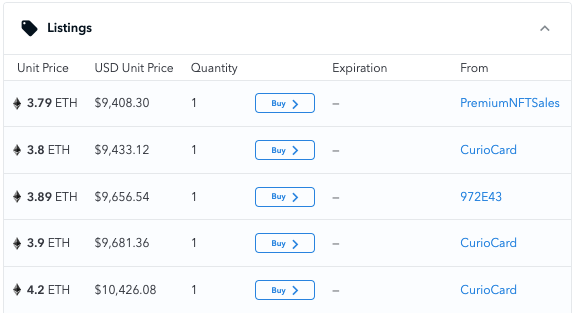

At a current price of 3.79 ($9,408) it’s still significantly higher than what it was just a week ago (I bought it for under 1 ETH) but supply plays a large role in what just happened.

Apples have a total supply of 1,809 cards and an estimated 830 are in “active supply”.

Note: Because this set launched in 2017, there are some “dead wallets” defined as inactive for 1,000+ days that hold cards. We don’t know if or when they could become active.

This isn’t the rarest Curio Card (a few cards have an active supply of 65) so it’s not surprising that early holders wanted to cash out.

Why would people sell if it’s going up in price?

There are 484 copies active on OpenSea right now, with 213 owners.

That means, on average, an owner holds at least 2 Apples, and in some cases, more.

For example, CurioCard on OpenSea has 4 Apples and they’re all listed for sale:

Source: Opensea.io

In April of 2021, these cards were selling for .15 ETH ($500 — $600).

For those who hold multiple copies, it makes sense to sell a few, take their profits, and hold 1 to see what happens in the long term.

Even die-hard collectors have a number

Although it’s rare, there are some collectors who will never sell a collectible regardless of the price they are offered.

In those cases, it’s typically a collectible that has a tiny population, say 2–3 copies (physical or digital).

But for collectibles with a larger population, it’s hard for the average collector to turn down $9,000 profit, especially when that person has multiples of that particular collectible.

Even though I believe in the Apple long-term (again, I own 1, please do your own research), I also know that because of a higher supply, people will look to “cash-out” at various price points.

So, where does Apple go from here and how can I use this example in my own collecting?

I don’t have a crystal ball — I bought a few Curio Cards because I know how important “firsts” have been in other collectible markets.

For example, someone paid $22,000 for a Tom Brady card. It wasn’t a rookie. It’s a low population (17 copies) of the first year of a particular card set (2012 Prizm).

Typically, historical items are lost and damaged because they weren’t worth much at the time. The same mechanism might be in play for Curio Cards with forgotten wallets.

Regardless, from my past experiences, the floor on Apple will go higher. Someone who bought at .1 ETH is happy to sell for 2 ETH, but the buyer at 2 ETH will hodl until it hits, say, 4 ETH.

It will continue to go in cycles, each time pushing a higher price point at the peak (if, and a big if, people remain interested in this set).

This always carries a risk, but it was clear that after it 2x’d value, supply for sale increased.

There are currently 6 Apples for sale under the previous record of 4.75. As more people buy at higher prices, the likelihood of them holding out for bigger returns goes up.

As you collect and buy NFTs, be mindful of supply. For the Apples, there are 484 copies, many still bought for little money and it won’t take much for those holders to sell and move on to rarer items.

Newsletter

Enter your email address below to subscribe to my newsletter

latest posts